Have you recently relocated to Germany and done with your Anmeldung or address registration? Then you might have already received a letter (or going to receive it in your mail box in coupe of days) from Beitragsservice asking you to register for the broadcasting contribution for the public Radio and TV services also known as GEZ fee (Gebühreneinzugszentrale).

Wondering why you received this letter as you just moved to Germany and have not used any of the public Radio or TV services? Don’t worry, it is the contribution every household in Germany has to pay independent of whether one uses the service or not. In Germany, the public broadcasting services works on a contribution model, so everyone has to pay it (there are some exemptions and reductions, please refer Rundfunkbeitrag website for details).

How to Pay the License Fee Online?

Once you receive the letter, you can register for the license fee payment online (or you can fill the form received and send it via post). We suggest you fill the online form as the process will be faster and safer.

To fill the online form, go to Rundfunkbeitrag website.

Click on Wohnung anmelden which means New Registration.

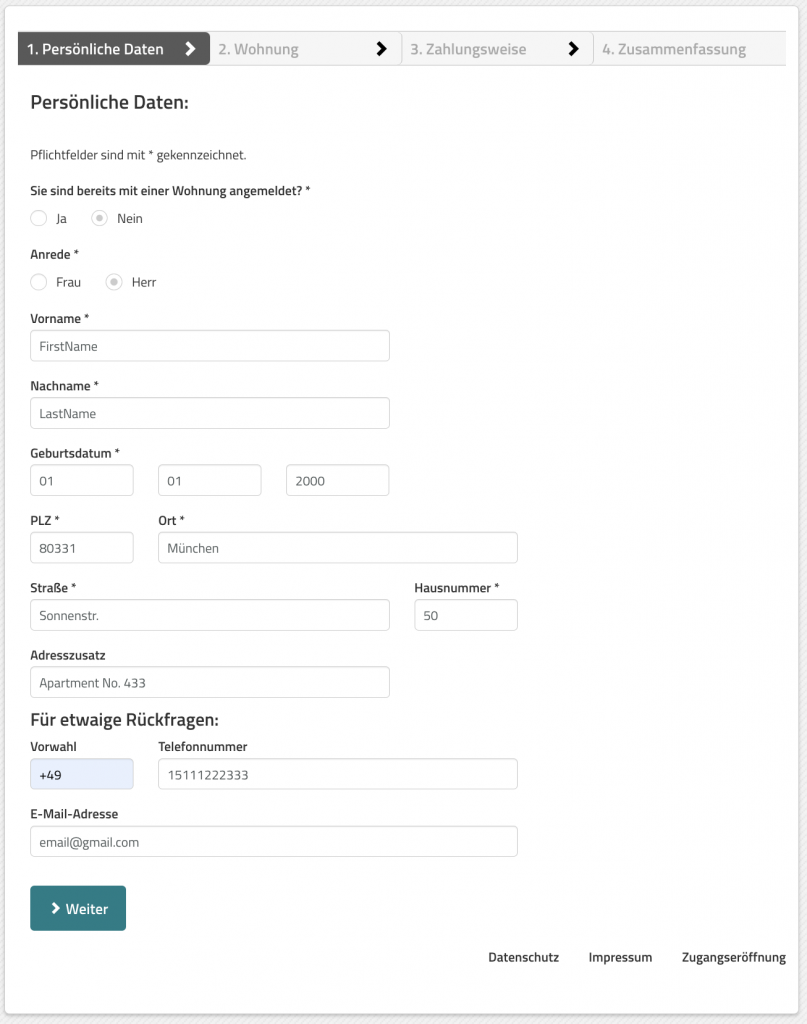

- Sie sind bereits mit einer Wohnung angemeldet? – Are you already registered with an apartment? – Choose Nein means No

- Anrede = Salutation, Frau = Mrs, Herr = Mr

- Vorname = First name

- Nachname = Surname

- Geburtsdatum = Date of birth

- PLZ = Post code, Ort = Location

- Straße = Street, Hausnummer = House number, Adresszusatz = Additional address

- Vorwahl = Phone prefix (ISD code), Telefonnummer = Phone number

- E-Mail-Adresse = Email address

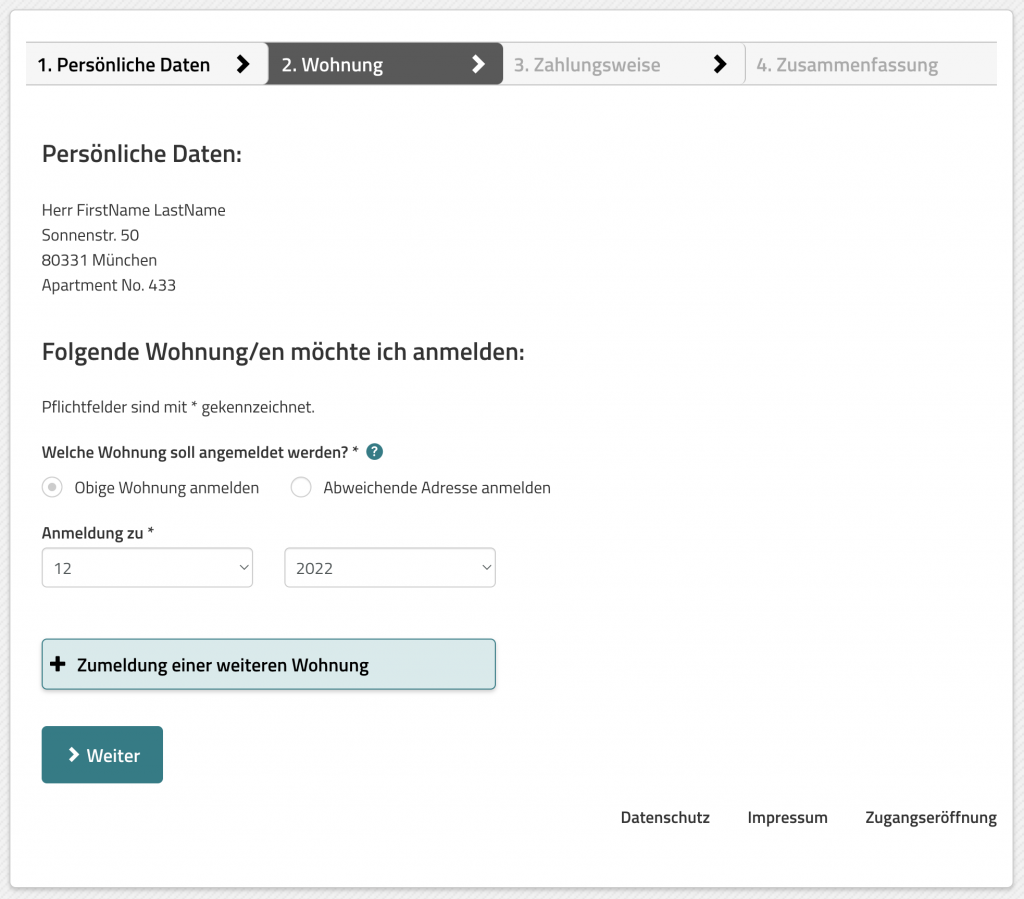

Welche Wohnung soll angemeldet werden? = Which apartment should be registered?

Select Obige Wohnung anmelden = Register the above apartment

Anmeldung zu = Registration Date (enter the month and year of address registration)

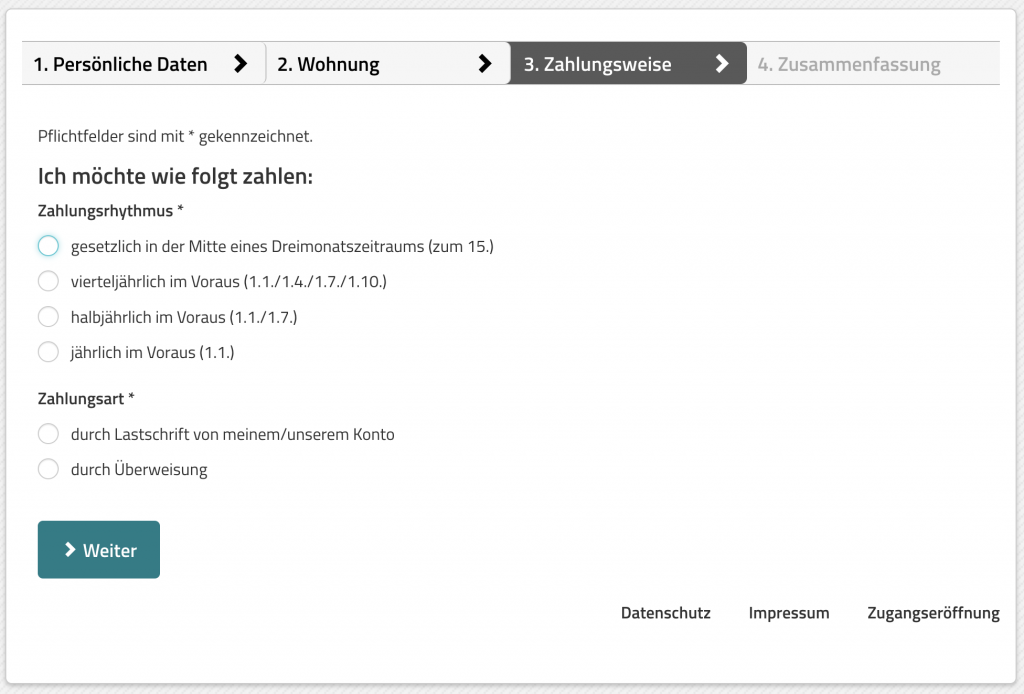

Zahlungsrhythmus – Payment frequency:

- gesetzlich in der Mitte eines Dreimonatszeitraums (zum 15.) – quarterly payment starting in the middle of the month

- vierteljährlich im Voraus (1.1./1.4./1.7./1.10.) – quarterly payment at the beginning of the month

- halbjährlich im Voraus (1.1./1.7.) – half yearly payment

- jährlich im Voraus (1.1.) – yearly payment

Zahlungsart – Payment type:

- durch Lastschrift von meinem/unserem Konto – direct debit (you have to fill and sign the DD authorisation letter for this payment type)

- durch Überweisung – bank transfer

Registration confirmation

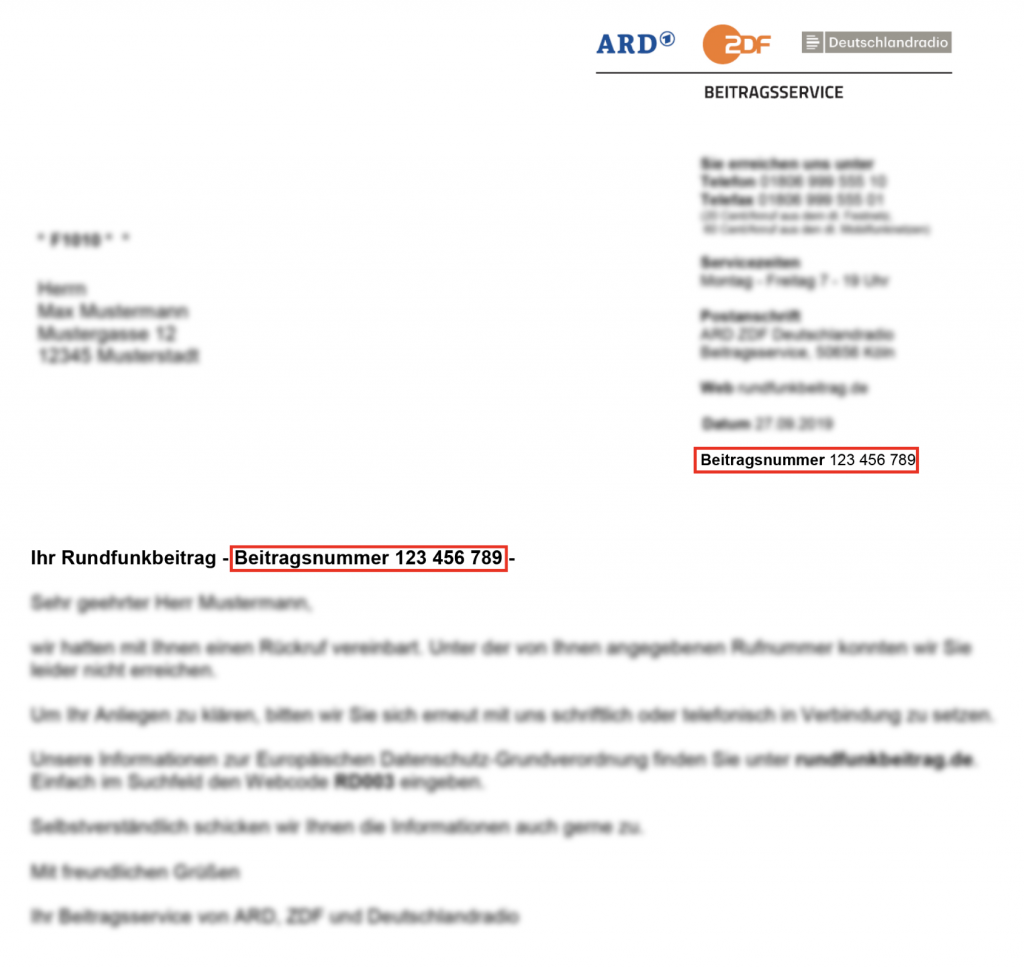

Once you submit the form, you will get a confirmation screen with an option to download the registration details. Download the form and keep it safe for your reference. You will soon receive another mail via post which will have your Beitragsnummer (contract number) using which you can pay the license fee as per the payment frequency you have selected during the registration process. The initial letter will have only the Beitragsnummer and the payment reminder letter (orange) which you will receive as per your payment frequency will have all the payment details.

What happens if you don’t pay Radio Tax?

You will get reminders to pay radio tax from the authorities and even you don’t pay tax, they may take legal actions against you, also your SCHUFA score will be affected. So, we advise you to make the payment without fail.

Frequently Asked Questions

- Should everyone living in a house/flat pay the radio tax?

- No, only one person from each house/flat should pay the radio tax

- I am not watching public TV or not listening to the radio, should I pay Radio/TV tax?

- Yes, independent of whether you use the public broadcasting services, you are bound to pay the license fee

- Should I cancel the registration if I am moving out of Germany

- Yes, you must cancel the registration before moving out of Germany

Add Comment